Conscious spending in turbulent times

Conscious spending in turbulent times

Turbulent times

Consumer markets have been facing an unprecedented level of turmoil in recent years: the Covid-19 pandemic, the war in Ukraine and the related sanctions, soaring energy prices and global supply chain disruptions, extreme weather conditions and climate change as well as potential shortages of food or other natural resources combined create “the perfect storm” (Sources: GlobalData, Euromonitor, Mintel).

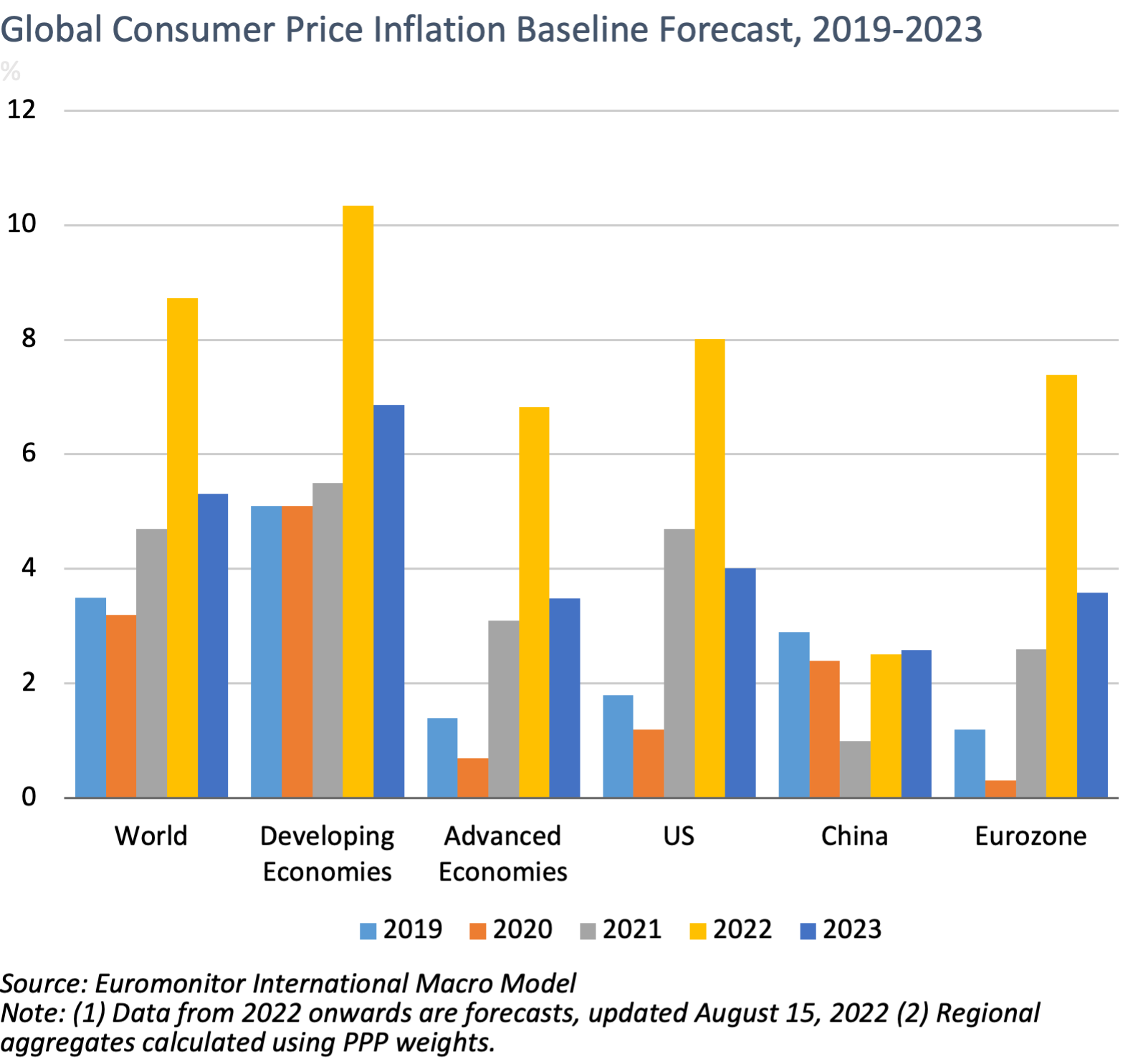

According to Euromonitor International’s Macro Model, global inflation is forecast to remain high over 2022 and 2023 because of rising food and energy prices and ongoing supply-demand imbalances – see chart below:

55% of consumers globally are extremely concerned about the impact of inflation on their household budget according to a Q3 2022 GlobalData consumer survey. Although inflation is a global topic currently, especially Western economies having the highest inflation rates, with the US & UK seeing 40-year highs and Argentina and Turkey currently experiencing hyperinflationary environments.

How consumers are reacting to the inflationary environment

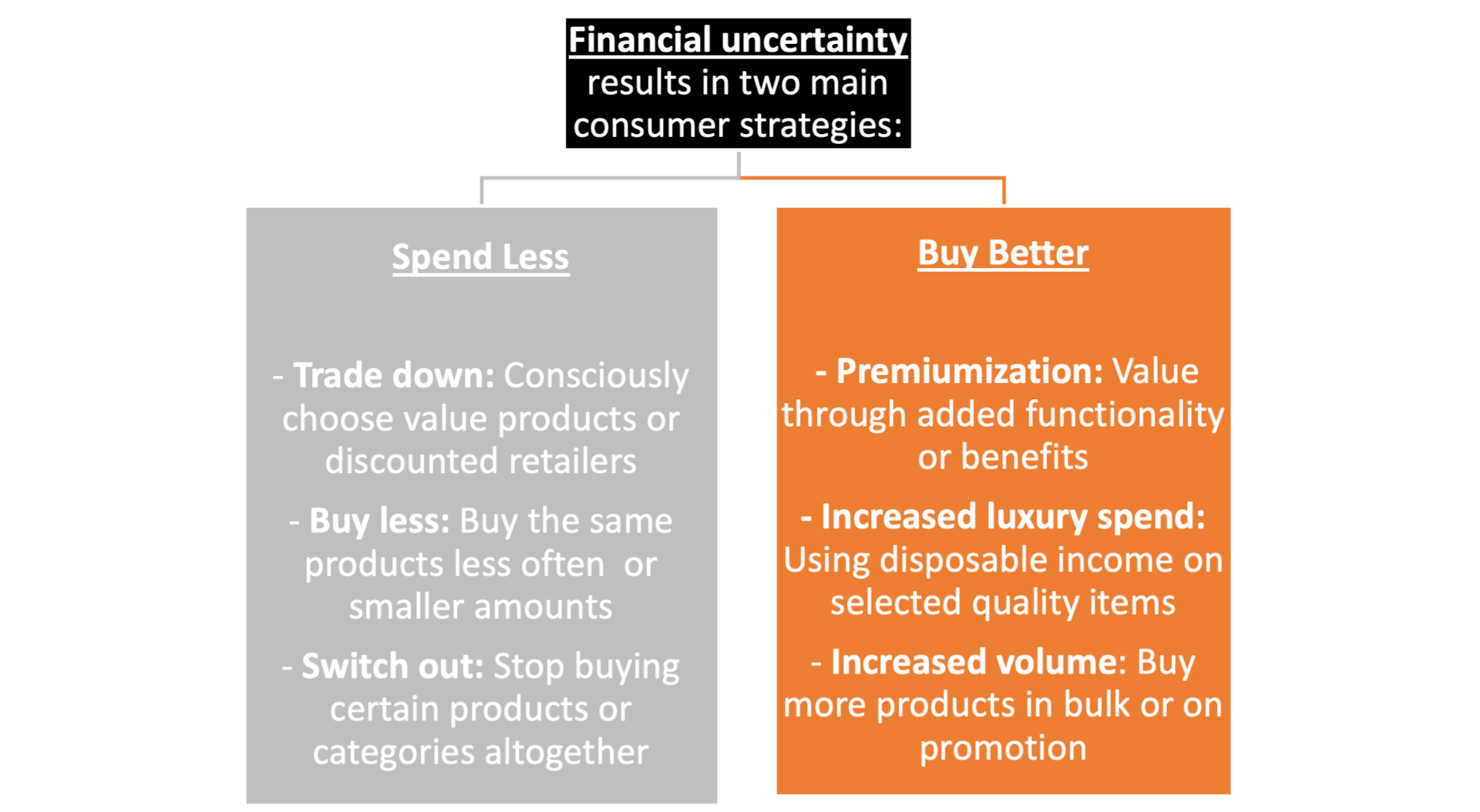

Financial uncertainty results in two major consumer strategies:

Source of image: GlobalData

This means consumers either opt for back-to-basics options or look for real added value solutions. The space in the middle ground of the mass market will feel the most pressure.

Which of the routes consumers take depends a lot on the respective category or goods consumers consider purchasing. They are much more likely to cut back on discretionary spending like dining out or other leisure activities. Also, non-essential categories, like electricals or furniture, are going to be hit hard by consumers not buying at all or delaying bigger purchases.

Conscious spending on food & drink

Although the food & drink category is essential and thus less impacted by the rising costs than other categories, conscious spending is still top-of-mind for many consumers in this category: In food choices, cost and value for money have become more important to every second consumers globally (Source: Innova Market Insights).

According to the FMCG Gurus survey on the rising cost of living in 2022, consumers will react in the following ways to increasing food and drink prices:

Opportunities for food & drink manufacturers

Although circumstances are turbulent, there are also opportunities for food & drink manufacturers: Remember the credo “don’t confuse value with low cost!”

We have identified the following opportunities for food and drink brands:

- Premiumization: Value through added functionality or benefits:

- Functional foods: 74% of consumers globally are willing to pay extra for products with certain health benefits. (FMCG Gurus)

- Natural foods: For 71% of consumers globally, products that are free from additives are worth paying more for. (FMCG Gurus)

- Sustainable products: 66% of consumers globally are ready to pay more for products that are environmentally friendly. (FMCG Gurus)

- Quality products: For more than 40% of consumers globally, “good value for money” in food products means high quality ingredients.

- Increased luxury spending: Consumers will consciously use disposable income on selected premium items. Food is not just nutrition but is often associated with a treat or reward. Especially more indulgent categories like ice cream, confectionery or snacks fall into this area. There are many opportunities to create affordable “escape moments” of indulgence in everyday life with food & drink products.

- Increased volume: Instead of buying less, some consumers will buy more. We see two patterns here: 1) Purchasing bigger pack sizes: The value for money ratio is usually better for bigger pack sizes and thus an increase of family-pack products can currently be observed for food & drink products. 2) Purchasing multi-pack offers or bulk: Some consumers will also turn to promotions more and stockpile goods at home they purchase at the best value for money point.

Interested in more?

Although times are challenging, we have identified various opportunities to position food & drink products for spending-conscious consumers. At AGRANA Fruit, we have vast experience and expertise in co-creating dairy, ice cream, and food service products with our customers to always reflect current consumer demand globally.

Also, for inflationary times we have a vast range of solutions we can tailor to every customer and brand such as:

- preparations adding functionality to dairy or ice cream products to address health topics like immunity, mental wellbeing, or energy

- all-natural fruit preparations only including fruits and sugar as ingredients, satisfying the need for high-quality and additive-free solutions

- a range of preparations with big fruit pieces or inclusions (chocolate splits, cheese balls, vegan cake inclusions, etc.) to create a pleasure moment that stands out.

Get in touch with our experts to co-create products capable of standing up to the challenge of turbulent times!